The commitment of the private sector to fighting corruption is critical to healthy economic development. It helps ensure fair and safe markets, and the overall well-being of societies. States can help the private sector promote business integrity by playing a dual role: they can impose sanctions for misconduct and provide incentives for the implementation of good practices.

Sanctions1 alone do not result in best outcomes for reducing corruption in the private sector. Rather, governments are increasingly opting for a ‘carrot and stick’ approach by using incentives to foster business integrity as well. Promoting business integrity requires finding the right mix of sanctions and incentives.

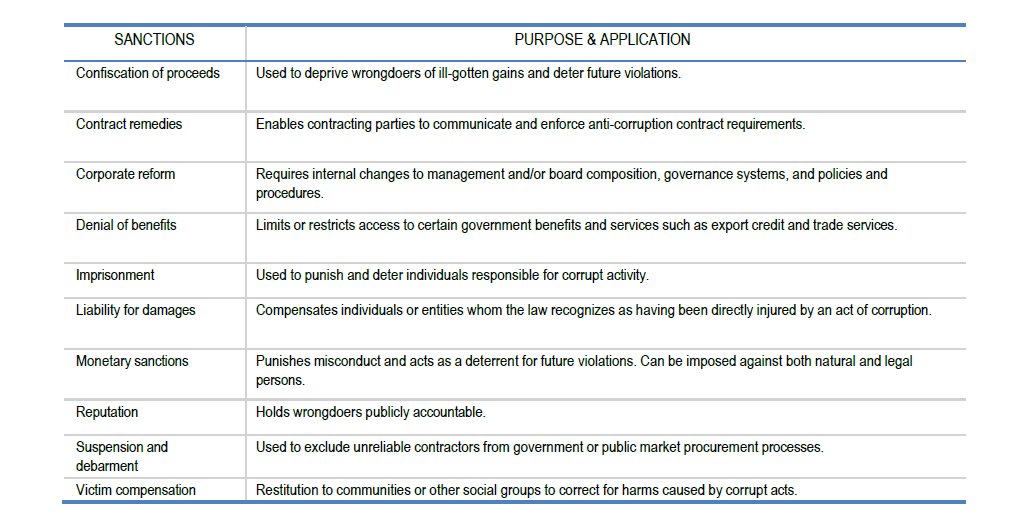

Sanctions that are “effective, proportionate and dissuasive” are a baseline United Nations Convention against Corruption2 (UNCAC) and Convention on Combating Bribery of Foreign Public Officials in International Business Transactions3 (OECD Anti-Bribery Convention) requirement for both natural and legal persons that commit a corruption offence. Certain sanctions are mandatory under UNCAC, while others are only recommended. For the purposes of the OECD Anti-Bribery Convention, the Parties must, at a minimum, have sufficient sanctions to enable effective mutual legal assistance and extradition, but the OECD Working Group on Bribery in International Business Transactions (OECD Working Group on Bribery) will examine closely whether each of its members’ overall mix of sanctions is optimal. In addition, confiscation of the bribe and the proceeds of bribery of a foreign public official is a complementary measure that must be available in addition to criminal, administrative, or civil sanctions. The examples and descriptions of sanctions can be found in chapter VI.

In a business context, sanctions can be considered effective and dissuasive if they adequately punish misconduct, eliminate illegal gains, and encourage measures to prevent future misconduct. Proportionality considerations are related to the company itself, as well as to the gravity of the offence and the harm caused. Within these parameters, States have wide discretion to implement many different forms of sanctions, and many make them available to law enforcement agencies or courts on a discretionary basis.

Regardless of the sanction chosen, States must provide adequate resources to enforce them. Implementation and enforcement must take stock of the practical realities in any given jurisdiction.

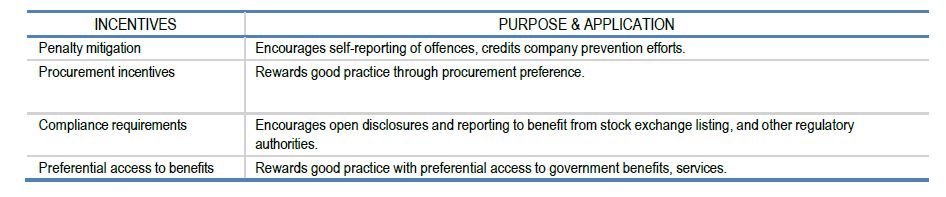

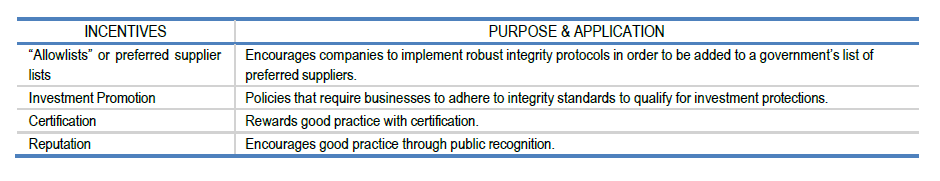

Incentives that reward a company for good practice are an important complement to sanctions. They recognize that meaningful commitment to, and investment in, anti-corruption programmes and other measures that strengthen business integrity are often voluntary, extending beyond certain minimum legal requirements. States may consider granting public advantages, including public subsidies, licenses, procurement contracts, development assistance and export credits to those that abide by good practice requirements. See chapter VI for more on incentives.

Incentives that reward good practice are not a substitute for sanctions when offences occur but can be an effective tool for encouraging self-reporting and proactive investments by companies in prevention programmes. This complementary role can be especially valuable for State efforts to raise business integrity in circumstances where the risk of detection and punishment is too low. In this case, government authorities are encouraged to strengthen their detection and enforcement capacities while incentivizing companies to adopt strong anti-corruption programmes. At the same time, it is important that incentives be conditioned on robust prevention efforts and not awarded too freely. Incentives such as penalty mitigation measures can be offered to entities that have been proven to have committed an offence but show remediation efforts and cooperate with authorities over the course of an investigation or prosecution. Nonetheless, incentives that are overly generous or misapplied undermine UNCAC and OECD anti-bribery standards, as well as public confidence in the administration of justice.

This resource guide provides States with a framework for identifying and implementing an appropriate mix of sanctions and incentives for encouraging business integrity. It reflects the latest developments in the global experience of countering corruption. These include, notably, UNCAC as well as the OECD Anti- Bribery Convention and its associated 2021 OECD Anti-Bribery Recommendation.4 This publication has been prepared in furtherance of the resolution 10/12, entitled “Providing incentives for the private sector to adopt integrity measures to prevent and combat corruption”, which was adopted by the Conference of the States Parties to the United Nations Convention against Corruption at its tenth session in December 2023.5 It covers the most important topics related to business integrity and contains case studies that serve to share information and practices, and provide inspiration to States and the private sector.

This guide begins with an overview of the international standards from the United Nations and OECD (chapter II), discusses the role of governments (chapter III), the private sector (chapter IV), and elaborates on the multi-stakeholder approach to enhancing business integrity (chapter V). The guide then delves into the various sanctions and incentives (chapter VI) available to States and provides a few additional measures (chapter VII) that States should consider. The guide concludes with a summary of good practices and common pitfalls (chapter VIII) to assist States in their implementation of the tools available to them as described throughout the guide.